Average Lifetime Value Of A Patient

Customer lifetime value (CLTV) is one of the most important metrics to measure at any growing company. By measuring CLTV in relation to cost of customer acquisition (CAC), companies can measure how long it takes to recoup the investment required to earn a new customer — such as the cost of sales and marketing. If you want your business to acquire and retain highly valuable customers, then it's essential that your team learns what customer lifetime value is and how to calculate it. Customer lifetime value (CLV, or CLTV) is the metric that indicates the total revenue a business can reasonably expect from a single customer account throughout the business relationship. The metric considers a customer's revenue value and compares that number to the company's predicted customer lifespan. Businesses use customer lifetime value to identify customer segments that are most valuable to the company. The longer a customer continues to purchase from a company, the greater their lifetime value becomes. This metric is something that customer support and success teams can directly influence during the customer's journey. Customer support reps and customer success managers play critical roles in solving problems and offering recommendations that increase customer loyalty and reduce churn. Here are some reasons why understanding your CLV is essential: The CLV identifies the specific customers that contribute the most revenue to your business. This allows you to serve these existing customers with products/services they like and make them happier, resulting in them spending more money at your company. According to HubSpot Research, 55% of growing companies think it's "very important" to invest in customer service programs. If we look at companies with stagnant or decreasing revenue, only 29% said this investment was "very important." Companies that are actively geared towards customer's success are experiencing more revenue because of increased customer satisfaction. When a company optimizes its CLV and consistently provides value — in the form of excellent customer support, products, or a loyalty program — it tends to increase customer loyalty and retention. And with more loyal customers comes a lower churn rate, as well as an increase in referrals, positive reviews, and sales. When you know the lifetime value of a customer, you also know how much money they spend with your business over a period of time — whether it's $50, $500, or $5000. Armed with that knowledge, you can develop a customer acquisition strategy that targets customers who will spend the most at your business. Acquiring a new customer can be a costly affair. In fact, an article published by Harvard Business Review found that gaining a customer can cost anywhere between five and 25 times more than retaining an existing one. Additionally, another study conducted by Bain & Company found that a 5% increase in retention rate can lead to a rise in profit between 25% to 95%. These stats show it's essential that your business identifies and nurtures the most valuable customers that interact with your company. By doing so, you'll have higher profit margins, increased customer lifetime values, and reduced customer acquisition costs. Now, let's learn how to calculate CLV in the next section. To calculate customer lifetime value, you need to calculate the average purchase value and then multiply that number by the average number of purchases to determine customer value. Then, once you calculate the average customer lifespan, you can multiply that by customer value to determine customer lifetime value. Customer Lifetime Value = (Customer Value * Average Customer Lifespan) where Customer Value = Average Purchase Value * Average Number of Purchases Now, the formula above is simplifying a lot of variables and you may be wondering what metrics like "Average Purchase Value" are and how to calculate them. Below, we simplify things by providing you with two models that companies will use to measure customer lifetime value. In the following section, we'll break down what metrics like Average Purchase Value are and how to calculate them, so you'll have all the knowledge you'll need to calculate customer lifetime value. The historical model uses past data to predict the value of a customer without considering whether the existing customer will continue with the company or not. With the historical model, the average order value is used to determine the value of your customers. You'll find this model to be especially useful if most of your customers only interact with your business over a certain period of time. However, because most customer journeys are not identical, this model has certain drawbacks. Active customers (deemed valuable by the historical model) might become inactive and skew your data. In contrast, inactive customers might begin to buy from you again, and you might overlook them because they've been labeled "inactive." Unlike the historical customer lifetime value model focusing on past data, the predictive CLV model forecasts the buying behavior of existing and new customers. Using the predictive model for customer lifetime value helps you better identify your most valuable customers, the product or service that brings in the most sales, and how you can improve customer retention. Read on to learn about the different metrics needed to calculate customer lifetime value and why they're important. Calculate this number by dividing your company's total revenue in a period (usually one year) by the number of purchases throughout that same period. Calculate this number by dividing the number of purchases by the number of unique customers who made purchases during that period. Calculate this number by multiplying the average purchase value by the average purchase frequency rate. Calculate this number by averaging the number of years a customer continues purchasing from your company. Multiply customer value by the average customer lifespan. The multiplication will give you the revenue you can reasonably expect an average customer to generate for your company throughout their relationship with you. Using data from a Kissmetrics report, we can take Starbucks as an example for determining CLTV. Its report measures the weekly purchasing habits of five customers, then averages their total values together. By following the steps listed above, we can use this information to calculate the average lifetime value of a Starbucks customer. First, we need to measure average purchase value. According to Kissmetrics, the average Starbucks customer spends about $5.90 each visit. We can calculate this by averaging the money spent by a customer in each visit during the week. For example, if I went to Starbucks three times and spent nine dollars total, my average purchase value would be three dollars. Once we calculate the average purchase value for one customer, we can repeat the process for the other five. After that, add each average together, divide that value by the number of customers surveyed (five) to get the average purchase value. The next step to calculating CLTV is to measure the average purchase frequency rate. In the case of Starbucks, we need to know how many visits the average customer makes to one of its locations within a week. The average observed across the five customers in the report was found to be 4.2 visits. This makes our average purchase frequency rate 4.2. Now that we know what the average customer spends and how many times they visit in a week, we can determine their customer value. To do this, we have to look at all five customers individually and then multiply their average purchase value by their average purchase frequency rate. This lets us know how much revenue the customer is worth to Starbucks within a week. Once we repeat this calculation for all five customers, we average their values to get the average customer's value of $24.30. While it's not explicitly stated how Kissmetrics measured Starbucks' average customer lifetime span, it does list this value as 20 years. If we were to calculate Starbucks' average customer lifespan, we would have to look at the number of years each customer frequented Starbucks. Then we could average the values together to get 20 years. If you don't have 20 years to wait and verify that, one way to estimate customer lifespan is to divide 1 by your churn rate percentage. Once we have determined the average customer value and the average customer lifespan, we can use this data to calculate CLTV. In this case, we first need to multiply the average customer value by 52. Since we measured customers on their weekly habits, we need to multiply their customer value by 52 to reflect an annual average. After that, multiply this number by the customer lifespan value (20) to get CLTV. For Starbucks customers, that value turns out to be $25,272 (52 x 24.30 x 20= 25,272). Now that you know your customer lifetime value, how do you improve it? Here are some strategies that can help. Customer onboarding is one of the first interactions your audience would have with your brand after they decide to become customers. It's also the first chance you have to impress them. So unless you want to lose your customers in the first week, you need to optimize your onboarding process to make these customers familiar with your products and services. When done right, onboarding motivates customers to come back to your products time and time again, thus increasing their lifetime value. Best practices for customer onboarding include: You can increase your customer lifetime value by overdelivering on your brand promise. Many brands already make bold claims they can't meet, so it comes as a welcome surprise to customers when they come across a brand that over-delivers on its promise. One of the smartest ways to improve your CLV is to increase your average order value. When a customer is about to check out, you can offer relevant complementary products to those they're about to buy. Brands like Amazon and McDonald's are examples of companies that use the upsell and cross-sell method extremely well. Amazon will offer you related products and bundle them into a group price as depicted below. Image Source While McDonald's will sell you on those tasty treats and desserts right before you finished your order. I can't tell you how many times I've fallen for the, "would you like an apple pie with that?" trick. If you're a subscription-based company, you can increase your average order and customer lifetime value by encouraging your customers to switch to an annual billing cycle. Customers spend on products because they're trying to fulfill a need. To boost your customer lifetime value and reduce your churn rate, you need to think beyond the immediate need a customer is trying to satisfy. As such, you'll need to engage and build a relationship with your customers. Standard practices around relationship-building include: 90% of Americans admit that customer service is one factor they consider when choosing companies to do business with. It, therefore, goes without saying that if you want to improve your customer lifetime value, you should pay attention to your customer service and look for ways to make it excellent. You can improve your customer service by offering existing customers personalized services, omnichannel customer support, and a proper return or refund policy. Customer lifetime value is an incredibly useful metric. It tells you which customers spend the most at your business and which ones will remain loyal to you for the longest amount of time. Use the formulas and model provided above and start calculating CLTV for your business today. ![→ Download Now: Customer Service Metrics Calculator [Free Tool]](https://no-cache.hubspot.com/cta/default/53/e24dc302-9dc2-466f-a5ca-ab4e08633c0f.png)

What is Customer Lifetime Value (CLV)?

Why is Customer Lifetime Value Important?

1. It directly affects your revenue.

2. It boosts customer loyalty and retention.

3. It helps you target your ideal customers.

4. It reduces customer acquisition costs.

How to Calculate Customer LTV

Customer Lifetime Value Model

Historical Customer Lifetime Value

Predictive Customer Lifetime Value

Customer Lifetime Value Formulas

Average Purchase Value

Average Purchase Frequency Rate

Customer Value

Average Customer Lifespan

Customer Lifetime Value (CLTV)

Customer Lifetime Value Example

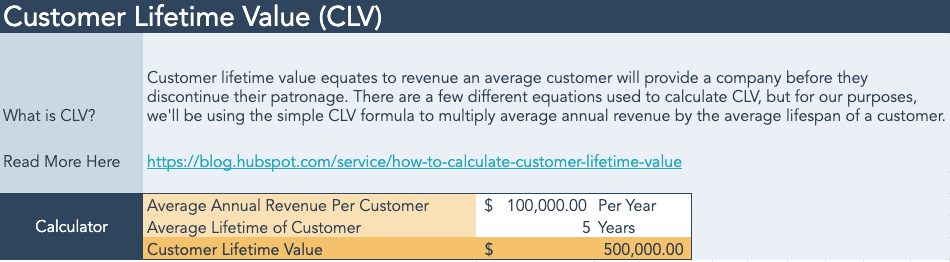

Follow Along with HubSpot's CLV Calculator Template

Download Now

Download Now 1. Calculate the average purchase value.

2. Calculate the average purchase frequency rate.

3. Calculate the average customer's value.

4. Calculate the average customer's lifetime span.

5. Calculate your customer's lifetime value.

Improving Customer Lifetime Value

Optimize your onboarding process.

Underpromise but over-deliver.

Increase your average order value.

Engage and build your relationship with your customers

Improve your customer service

The Benefit of Customer Lifetime Value

Originally published May 6, 2021 4:15:00 PM, updated August 25 2021

Average Lifetime Value Of A Patient

Source: https://blog.hubspot.com/service/how-to-calculate-customer-lifetime-value

Posted by: fullerdaunt1999.blogspot.com

0 Response to "Average Lifetime Value Of A Patient"

Post a Comment